How much should you save in your Emergency Fund?

Some may say 3 months’ salary, others may say 6, but they all say the same thing: you need an emergency fund in your savings account. But if you ask me, the whole concept of an Emergency Fund is a genius scam fueled by financial institutions.

Some may say 3 months’ salary, others may say 6, but they all say the same thing: you need an emergency fund in your savings account. But if you ask me, the whole concept of an Emergency Fund is a genius scam fueled by financial institutions.

Let’s say the average person makes $50,000 annually. This means your emergency fund should be up to $25,000. You leave your emergency fund in your savings account, making so little interest you’re practically losing money once you factor in inflation.

Meanwhile, this financial institution is lending out your $25,000 at 19.99% interest to another poor consumer who they’ve convinced to take on more credit card debt than they can manage. And in return, all you’re getting is a measly 0.1% … 0.8% if you’re lucky.

In other words, the reason why I don’t believe in Emergency Funds is because Savings Accounts pay so little interest. If you have access to low-cost borrowing that you could easily access in the event of an emergency such as a Home Equity Line of Credit, it would be in your best interest to invest your Emergency Fund money instead.

If an emergency never arises, you’re in the best possible position, and even if an emergency does arise, you’re still in a much better position than you would have been if you had saved the cash in a savings account.

CIBC’s Bonus Savings Account currently boasts a rate of 0.10% annually… if your balance is over $3,000. That’s 0.0083% per month.

Now let’s take a look at their sister company, PC Financial, known for their low fees and high interest. Their Interest Plus Savings Account has an interest rate of 0.8%. That’s 0.067% per month.

So let’s say Mr. A puts $12.500 in his CIBC savings account and $12,500 in his PC Savings account. After one month, his emergency fund of $25,000 will have grown to $25,009.38.

So after an entire year of going by the book and sitting on his $25,000 emergency fund, he’s now made $112.87 in interest, for a grand total of $25,112.87.

Now let’s meet Mrs. Z. Assume that instead of saving the $25,000 like Mr. A, she invested it in the CIBC Global Monthly Income Fund, which posted a moderate return of 5.4% last year. After one year at 5.4%, she now has $26,383.92, having made $1,383.92 in interest, a difference of $1,271.05.

Let’s also assume she owns a home, which qualifies her for a Home Equity Line of Credit, with a low interest rate of 3.2%.

Now, at the beginning of Year 2, both Mr. A and Mrs. Z find themselves in a bit of a sticky situation and now owe $25,000.

Mr. A cashes out his savings account, leaving him with a total of $112.87. He transfers it to his higher savings account at PC, and at the end of Year 2, he now has $113.78.

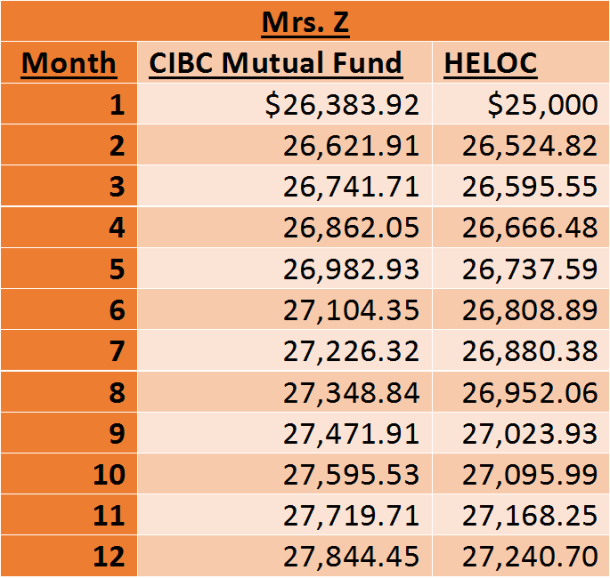

Mrs. Z, on the other hand, leaves her Mutual Funds untouched, and instead borrows the $25,000 from her Home Equity Line of Credit (HELOC) at a rate of 3.2%.

So, at the end of the year, even though she now owes $27,240.70, her mutual fund is now worth $27,844.45. Even after she cashes it out to pay off her HELOC balance, she still has $603.75, $489.97 more than Mr. A.

What do you think? Do you keep an Emergency Fund? If so, how much do you keep in it?

(Disclaimer: If you don’t have access to a HELOC or another source of easy access, low-cost borrowing, I would suggest you create an Emergency Fund with as low of a buffer as you’re comfortable with, then invest the rest.)

So basically its not really that an emergency fund is a scam just that where you save your emergency fund, that’s the scam. From the title I thought you were suggesting not to have an emergency fund.

LikeLike

I guess it depends on how you look at it. I don’t have an “Emergency Fund”, but I do have access to a home equity line of credit. I would still choose to invest the money even if it’s locked up (e.g. RRSP) instead of leaving it liquid but bearing almost no interest.

LikeLike

Interesting information and I see where you are coming from. For myself personally, I have reservation of putting my emergency fund outside of anything that cannot be easily accessible without incurring fees & interest and affecting my long term wealth. Some things to consider:

1) The general rule for emergency funds is 3-6 months of basic living expenses (so food, transportation, shelter & utilities). this is hopefully not 50% of someone’s salary as you would not save in your emergency fund the amount for leisure expenses and retirement etc.

2) 70% of Canadians are going to experience some financial hardship within the next 10 years of their lives. That’s a really high percentage so its not a matter of “if” for most people, its a matter of “when”

3) Keep in mind, pulling money out of a line of credit (whether a HELOC or unsecured) or taking a cash advance from a credit card accumulates interest from the 1st day. There is no grace period. To see how this can impact the cost of borrowing over time, check out my post:

http://mymoneycounts.org/2016/01/29/what-does-e-a-r-mean-to-your-debt-or-savings/

I like to keep my emergency fund in a Tangerine savings account, the interest is not that great, but it beats the big 5 banks.

LikeLiked by 1 person

Thanks for your input! I do see what you’re saying about the interest accruing and the likelihood of Canadians running into financial difficulty. I just can’t seem to wrap my head around essentially losing money just in case there’s an emergency versus trying to actually make that money grow.

Granted, returns in mutual funds (or anything else, really) aren’t guaranteed, so the numbers were purely hypothetical. There’s obviously the chance that your mutual fund declines (hopefully just in the short term) and is down when you need your emergency cash.

Everyone needs to do what they feel most comfortable with given all the facts, but I just thought some might want to reconsider storing huge amounts of cash in a savings account if they don’t really need to.

LikeLiked by 1 person

Yah I know what you mean. Great post.

LikeLiked by 1 person

Thank you!

LikeLiked by 1 person

This is what I’ve been thinking about lately. Personally, I think having that emergency fund is necessary. Just in case.

LikeLiked by 1 person

I do think it’s a good idea to have some money set aside just in case, but probably not the 3-6 months that financial institutions seem to tout all the time.

LikeLike

Yeah, I guess so. I am having a hard time saving up for that amount. I’d rather spend some of it on investments and books and seminars.

LikeLiked by 1 person

I’m afraid I have to completely disagree. You are not thinking about the risk that comes along with investments – that when you need the money in the short term say a three or six month period, the market will be down and you will have less money than you needed (remember 2008-2009). Taking on a home equity loan is similarly risky (and this lending froze in 2008). If it wasn’t risky, why not take out a Home equity loan and go invest it in the stock market today? DEBT is a four letter word.

LikeLiked by 1 person

Nope, you’re completely right when it comes to investment risk. I didn’t have a home back in 2008 but I was dating a real estate agent at that time when the Canadian markets were actually quite hot. I could be completely wrong, but as I understand, the home equity lines of credit weren’t frozen at that time in Canada, but thank you for calling that possibility to my attention!

Obviously all investments come with a certain degree of risk, but I also think that Emergency Funds stashed away in a savings account comes with 100% risk of loss of buying power, since the interest rates are currently lower than the rate of inflation.

I am not opposed to keeping a bit of money aside just in case, no more than $5,000 I’d say off the top of my head, but this post was more to address the common thinking of trying to save thousands and thousands in a savings fund before thinking about investing.

LikeLike

There is actually a better option than an “emergency fund” that is exponentially better than a traditional savings account, without the risks of a line of credit.

I could tell you how you could guarantee your money would grow, beyond inflation, that you could withdraw the money when you need it without penalties or tax, and that unlike a 401K or Annuity, your beneficiaries don’t get taxed either.

Sound too good to be true? Check out IRS code 7702.

Think of it this way:

A farmer goes to town to buy some seeds. The government is going to tax him on those seeds. But because the government is so kind (thick sarcasm) they say, “no, take the seeds and watch your farm grow. You won’t have to owe us anything right now.” Sounds good right? Wrong.

They come to collect when you have grown your investment. That way they can take a bigger chunk. (This is a traditional 401K scenario, where you get about 49% of what is actually in your account)

But there is a way to invest that money, have it grow at a specific rate regardless of market fluctuation beyond inflation, and you to have access to the equity you’ve grown without being penalized or taxed.

Everyone’s situation is slightly different, but I’ll be glad to show anyone how.

LikeLike

Thanks for all the information but I don’t think this would apply to Canadians…. unless you’re aware of similar rules in Canada?

LikeLike

Actually, the rules are similar, but you are correct, not the same. While the tax code in America has the death benefit loophole, in Canada, the tax code is different in that one must pay tax regardless. But what you pay tax on, how much and when is drastically different depending on the policy. There is a different between whole life, Universal life and Participating life. Here’s a quick synopsis from the Canada Life website :https://www.canadalife.com/003/Home/Products/LifeInsurance/PermanentInsurance/index.htm

By utilizing the concept of compounding interest in an insurance policy to your advantage, you can still grow your investment past inflation and have a number of benefits available that would never be possible with a traditional savings account. Many of the companies I represent are international companies and have similar provisions regardless of the country. Here’s an interesting overview from the Toronto Star: http://www.thestar.com/opinion/columnists/2007/04/29/using_life_insurance_to_your_tax_advantage.html

But don’t let that stop you, you can still take advantage of the American loophole. My wife is Canadian, our children are dual citizens, and we spend a great deal of time in the great north. We’ll make the transition one day to full time Canuck life. In the meantime, anyone who is in the US (traveling or on business) can actually purchase a policy in the US that may not be available in Canada (and vice versa). But the tax sheltering needed becomes a bit more complicated. Here’s an article from advisor.ca with a scenario explanation

http://www.advisor.ca/tax/tax-news/tax-problems-with-cross-border-life-insurance-117950

The bottom line is that an insurance policy is a great long term investment that can offer tax advantages and savings growth that are not available otherwise. Depending on your financial needs, there are options that could save you and your family a huge amount of headache and grief (not to mention money). While tax laws in Canada and the US are quite different, there are programs and policies in place to help you save your money that are far better than a bank and traditional retirement funds which are structured to make the institution money, not you.

LikeLiked by 1 person

While I absolutely in no way claim to be anywhere near an expert here, I have to very respectfully disagree with saying that life insurance “is a great long term investment.” In lieu of going into detail on the math here, I would like to reference the following article from Investopedia for a explanation behind the math of why this is not the case and that you would be better off to opt for term-life and invest the difference in a low-fee index fund: http://www.investopedia.com/articles/active-trading/120814/life-insurance-smart-investment.asp

Also, while I don’t know anything regarding taxes in Canada, Go Curry Cracker has an excellent article detailing how it is possible to retire and never pay taxes again here in the US. Hopefully it may pertain to your situation in Canada, as well. The article can be found here: http://www.gocurrycracker.com/never-pay-taxes-again/

While I understand that whole-life provides for the option of borrowing against the cash-value if needed, the math just doesn’t add up and you would be better to have a cash-in-hand type of emergency fund that easily accessible (such as in a savings account or even under the proverbial mattress you rest your head on.) Your emergency fund is not to be viewed as an investment with the aim of increasing your net worth. It is to be readily available if your water heater goes out, you drop the transmission in your car, or for any other curve ball that life likes to throw at us.

LikeLiked by 1 person

Based on my very limited knowledge/experience, I’d have to agree with Frugal RN. My Personal Financial Planning prof in university made it very clear that whole life was pretty much a bad option financially, unless it was the only way you could force yourself to save money. Something about whole life only really benefiting the agents selling it… In that vein, I’ve only purchased term life insurance – my premiums are way lower for much higher coverage, but in 20 years, I’ll (hopefully) have nothing to show for it and will have to get new term insurance at obviously a much higher premium.

LikeLiked by 1 person

Thank you very much…and thank you for following along with my blog! 🙂 I actually obtained my education on the subject of insurance from reading Dave Ramsey. You’re totally right, I have a 30-year level term policy for $250,000 that is costing us less than $300 a year. My plan is to purchase another policy in the next 5 or so years so that the policies overlap and that I can lock in lower premiums, instead of waiting for the current policy to expire (assuming I don’t die in the meantime…lol.) By the time my policy is up, we will be financially independent and, even if I were to die without a policy in place, my wife will not have to worry about needing the money anyway.

LikeLike

I don’t know that I would want to “expire” without having an insurance policy in place – even if I were already financially independent. For example, I know that in Canada, you have to pay Capital Gains tax on an inherited property. So if the parents die with a property left to their child(ren), the kid(s) will now have to fork over potentially huge sums of money just to inherit the property, presuming that the property has gone up in value from the time the parents purchased to the time that it was inherited by the child(ren). I don’t know the rules if one spouse survives the other, but at some point it will go to the next generation and will incur a big tax bill!

LikeLiked by 1 person

That’s completely understandable. Here in the States, there is an Estate Tax and, based on my reading of the IRS website, “most simple relatively simple estates…do not require the filing of an estate tax return.” Once gross assets are calculated, filing is only necessary if the value exceeds $5.45 million, as of 2016.

Therefore, if we somehow manage to exceed that figure (fingers crossed! :)) my measly $250k life insurance policy is rather small potatoes in comparison. Of note, I do also have additional life insurance through my work, as well.

As far as next generations are concerned, I’m a little fuzzy on understanding the wording of the exemption. It appears that the $5.45 million exemption applies and then the difference is carried over to the surviving spouse; so if the value of the estate then exceeds the remaining exemption after the spouse dies, I suppose surviving heirs may then owe some tax. That’s something that would require more extensive knowledge than I have at this point in time. But, all in all, I’m with you on the value of having term life insurance in place. The last thing I want is to die and leave my wife and son worrying about surviving financially. It’s a small price to pay for enormous amounts of peace of mind.

LikeLike