Forget “house rich, cash poor.” We’re house millionaires, but cash broke.

Yesterday, I was browsing www.mls.ca and was pleasantly surprised to find a house identical to mine up for sale. I always love looking at listings of the same model because I’m always so curious to see how they’ve furnished and decorated their home. However, I was incredibly shocked to see their asking price.

$999,000

Yup, they were asking for $1,000 short of one million dollars. WHAT?! How can my home be worth a MILLION dollars?! My home? The home belonging to this young couple who needs to rent out rooms to make ends meet and who are in deep debt?! And in case you’re wondering:

- No, the basement was not finished (like ours)

- No, they did not replace the ugly builder’s laminate on the main floor

- No, their paint job was nowhere near as nice as my husband’s (it was an ugly blue)

- No, they did not even have their banisters stained

- No, their kitchen was not upgraded, nor were their countertops or appliances

- No, their rental unit is not the same as ours (i.e. ours is a one bedroom, theirs appears to be a bachelor pad)

- But yes, they did have either laminate or hardwood floors upstairs (we still have carpet)

So all in all, I think it would be fair to say that based on the photos, their home is not more upgraded than ours, which leaves me in a little predicament:

Do I update our Net Worth sheet to reflect $999,000 as our house value?!

It blows my mind that the house could be listed for nearly $1,000,000 when just in 2012, we had purchased it brand new for ~$560,000 (including builder upgrades).

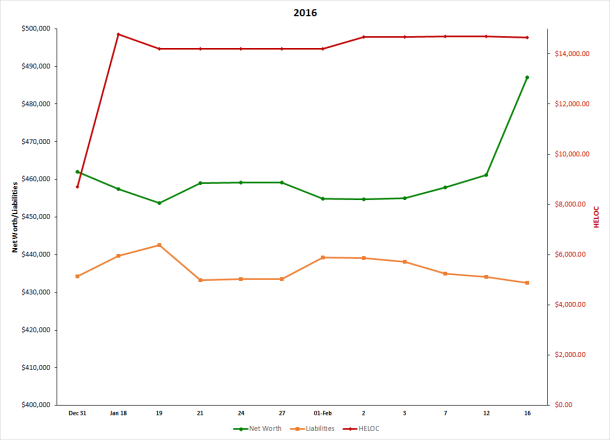

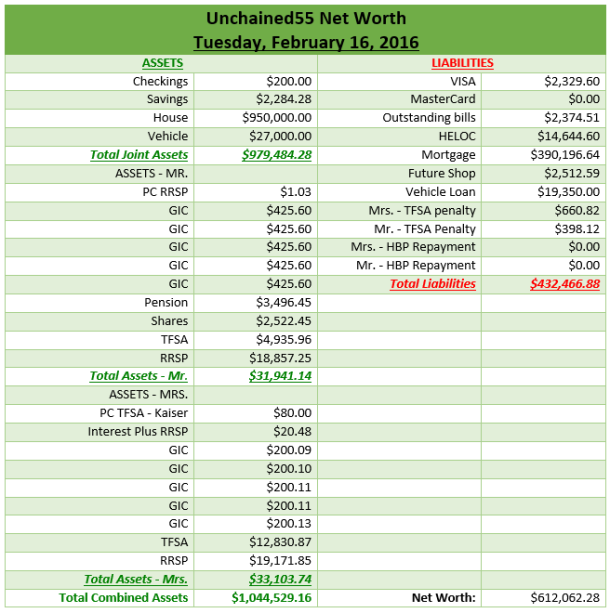

Previously, I had our house listed at $800,000, resulting in a Net Worth of $462,062.28. Since I’ve had realtors come knocking on our door asking if we’re willing to sell and saying that they had clients willing to pay up to $850,000 for a property like ours, I am comfortable increasing it to $825,000 instead, bumping our Net Worth up to $487,02.28.

However, if I change the number to $950,000, our Net Worth suddenly jumps up to $612,062.28. WHAT?!?! Our Net Worth literally jumps off the charts.

Don’t forget you owe over $400k on the house, between the mortgage and the HELOC. If the housing market tanks, and you end up underwater on your mortgage — you’ll still owe over $400k on your house.

That said, having a roommate is genius and I envy you the space to do that! Way to make your house work for you! Depending on space, you could even Airbnb every so often, and cash in even more–you might even make a month’s worth of roomie rent in a weekend. From the sound of it, your place sounds like it would be a hot commodity!

LikeLiked by 1 person

Oh don’t I know it! 😦 The amount of debt is always looming on my mind. As much as people have been saying that we’re in a real estate bubble, I can’t see it tanking at this rate (although maybe it will flatten out, perhaps even decline a tad) because the demand is just way too high! If prices went down significantly, I think a whole lot of people who are currently sitting on their savings waiting to buy will suddenly rush out and buy, inevitably bringing the prices back up (somewhat). That’s my theory anyway, but even a slight decline in the market will drop my Net Worth.

I’ve toyed with the idea of Air B&B but despite the crazy housing pries, we’re pretty much in the boonies and aren’t really close to any attractions or anything! Yeah, doesn’t make any sense to me either…. Also, the thought of having strangers in and out of our home makes me very wary. It’d be a different story if we maybe had a separate basement apartment (which was our original plan for the house actually!) but it’ll cost thousands to finish and I definitely don’t want to make the risky investment at this point in time.

LikeLiked by 1 person

I base the value of my house on the Zestimate that I find on Zillow.

LikeLiked by 1 person

Most unfortunately, it doesn’t appear that there’s a Canadian version of Zillow 😦 Too bad, because the site seems to have really great stats!

LikeLiked by 1 person

Oh, that’s too bad. I suppose that in this case we can call you, “The Millionaire Next Door”. Congrats. 🙂

LikeLiked by 1 person

Correction: The BROKE million-dollar home owner next door! 😉

LikeLiked by 1 person

LOL. Yes.

LikeLiked by 1 person

I would leave it at the amount you are sure you could get for YOUR house. The amount the other people are asking may be wishful thinking, until and unless they can actually sell it for $999,000.

It seems better to be conservative in estimates of asset values. Indeed, accountants have the “doctrine of conservatism”. (I know nothing of real estate prices in your country). This could be stated, in laymans terms, as “better to err on the side of caution”.

LikeLiked by 1 person

Yeah, I was thinking I should play it safe and leave my estimate on the lower side (which is what I’ve always done) but I do know that if I listed my house on the market for $825,000 at the moment, it’d either a) be gone in a second b) start a bidding war (quite common in our area.)

I know if I put a bit of money into our home to upgrade it (get rid of the carpets, upgrade the flooring and counters, finish painting, etc.) it could definitely sell for in the 900s but I am not confident it would sell for ~1M. It’ll be crazy if it does though, because it’ll set a precedent for all the other houses in the area!

LikeLike

We bought our house as a foreclosure 3 years ago! It didn’t have heat, water or septic. We have put a lot of work into it. Your post makes me excited!!!!

LikeLike

It sounds like it has so much potential! Is there a lot of land? We have a tiny backyard so there’s no room whatsoever for expansion or even a nice deck so we’ll just have to compensate with the interior design (eventually.) I always love watching those flipping houses shows!

LikeLiked by 1 person

I tried to copy a before and after pic but was unsuccessful! It’s a 13 room 225 year old farm house in New Hampshire, that we turned into a wellness studio! We only have 2 acres but we are surrounded by woods, so it feels like more! I love living there! My husband does most of the renovations!

LikeLike

Oops, I replied to the wrong comment (but at least right person.) 2 acres is AMAZING!!!!! My dog would be in heaven! Acreages only exist further north now, and are incredibly expensive or impossible to commute to/from. I’d still love to see the before/after photos though!

LikeLike

Oh how I’d love to see the before and after pics! Blog about it and post the link here? 🙂

LikeLike

I’m still trying to figure out how to post full size pics! A little of the top and bottom get chopped off 👎

LikeLike

Here is what ME, MYSELF, and I would do in your situation, especially considering you said above to @tenleygwen that the debt is”always looming on (your) mind.” SELL the house to the highest bidder!!!

While I don’t know where you live and realizedthat we may not have the same priorities, I say this from the standpoint that we never intend to live in such an “expensive” house (I use quotes because “expensive” is a very subjective term.) We look to cap ourselves, when we eventually decide to buy, at around $200k-ish.

Changing your net worth based on the potential value of your house is like a gain or loss in the stock market…it’s not locked in until you sell.

If I could sell the house for $900k, that would pay off the mortgage, leaving enough capital to either pay cash for another house and own it outright…or put down a significant down payment, take out a 15 year mortgage, and invest the rest in an index fund. While your net worth number may decrease, you would be completely debt free, own your home, have additional money making money in the stock market, and be cruising towards financial independence at an accelerated pace. And let’s not forget that, while I don’t know what your monthly mortgage is, that money would now be freed up to further invest, as well. Plus…no further need for a roommate. Win-win all around in my book!

Oh, how I wish I were in your situation! 🙂

LikeLiked by 1 person

Lol if only it were that simple! Our home is still on the modest side (just a tad over 2000 sq feet, 3+1 bedrooms). Where we are, you’d be lucky to get a town house for half a mil so if we sold, we’d have to “downsize” significantly for it to have a financial payoff. Part of the reason why the demand is so high is because of the rental property (it’s basically a fully detached 1 bedroom house with its own kitchen, bathroom, heating/AC, etc.) Because of the rental potential, they’re in high demand, but the city has limited how many there can be, so supply is low. So if we sold, we’d lose out on the indefinite rental potential so that’s definitely not an option (i.e. We could keep that rented forever even when we have a family as it’s a separate dwelling.)

On top of it all, we purchased in a brand new subdivision, so my grandparents, parents, and brother + sister-in-law all live a few house away. Our buying the house was definitely a very very long term decision lol. Unless the entire family decided to pick up and move, I see us being here for the next few lifetimes LOL.

LikeLiked by 1 person

That much family, that close? RUN!!! lol…kidding!!! 😀

In all seriousness though…I can/do completely respect your decision and rationalization. However, if we were in your situation (based on what I understand of it at this time,) and to remain completely honest, I would still do what I originally said. Again, that’s just me, myself, and I though.

To note, this is coming from a guy who, along with my wife and unborn child, loaded up a U-Haul and moved to the middle of nowhere South Dakota, 16 hours away from all our family back in Illinois…lol

However, it was and continues to be the greatest and most financially advantageous decision of our lives to date.

I just really wish you guys all the best; thank you for sharing and hearing me out on my wild ideas. 🙂

LikeLike

LOL your reaction is the same as 99% of everyone who knows of our situation. I don’t understand it lol my family is awesome! People usually assume my parents forced us to live close to them but in reality, it was the other way around! It took a LOT of persuasion to get the family to consider moving, but we all agree it was the best decision we ever made.

There’s nothing like walking over for dinners or being able to call up Mom or Grandma when you’re one egg short, or a technician is coming in the middle of the day, or someone needs to check up on something in the house while we’re at work.

It’s been the best financial decision too. My parents’ home has appreciated WAY more in the 4 years we’ve lived here than their close to 30 years in their old town home. Between the 8 of us, we have 2 cars less than we would have needed if we lived further apart which is a huge thing for us now as we obviously should not be buying another car and public transit is nearly non-existent here. Plus we have a lot fewer things because we can just share big things like the BBQ, lawnmower, big tools, etc.

The only downside to living here imo is the land (i.e. backyard) is so small and there’s definitely no room to expand! That’s not entirely bad though – we don’t have to spend a lot of time cutting the grass 😀

LikeLiked by 1 person

lol…I was only kidding; that’s really awesome that you all have such strong, healthy relationships. I definitely don’t envy your small yard though. I have gotten into gardening the past couple summers and intend to continue that for the foreseeable future so I would like to own a chunk of land one of these days. The good news is that where we rent, we have a nice yard that allows for me to make plenty of mistakes as I continue to learn the gardening process. Not gonna lie…it’s been more failure than success thus far! lol

But there really is nothing better than some fresh-outta-the-garden green beans and tomatoes. I’m excited for spring already! 🙂

LikeLike

There is much to be said for living near the people in your life. I figure that the biggest part of having a contented life is the people in your life.

The material requirements for a happy life need not be extensive or expensive.

LikeLike

I’d totally rent out a bedroom for cash. Houses are tricky in my opinion. Will the market actually pay for that price? I love your net worth, it’s like eye candy to me. I love blogs where people are open with their finances.

LikeLike

I was discussing with my parents this morning and at first we were all saying how crazy they were for asking nearly $1M! But then my dad pointed out that the builder was charging around $900k for the house during the last phase, and that was without the rental property, which is now an additional $100k, so I guess their math does actually add up! How much they’ll actually sell it for is still to be seen, but either way, it’s way more than what I’ve got it listed at on my balance sheet!

LikeLiked by 1 person

Where are you located? My hubby is a builder. 🙂

LikeLike

Ontario, Canada!

LikeLiked by 1 person

Hello from Virginia!

LikeLiked by 1 person

Personally, I take the price I paid and increase very modestly (about 4% per year + any upgrades at cost), to keep the price in line with historical real estate appreciation. The trouble with basing your net worth on what it is worth now is that real estate markets can be fickle – (see 1989 Canada, 2009 USA, right now Calgary). I would rather underestimate my net worth and be wrong in a conservative way, having to bump up my net worth if/when I do eventually sell. If markets happen to flatline or dip for some time, it would be very demoralizing to have to significantly reduce the net worth. So, although houses in my neighborhood typically sell for a couple of hundred grand more than I have mine estimated at, if the markets correct, my net worth will still be accurate. If real estate goes nowhere but up, then when I do eventually sell it will be like winning a small lottery. Just my nature. For what it’s worth, I also would reduce your car to the same value as the outstanding loan and call that a wash. One last thing – have you compared what you are paying in interest on the HELOC or other debts vs what you are making on the GIC’s, and if so, would it make sense to pay down those debts? Just a thought. Take care.

LikeLike

Thanks for weighing in! I had originally had the house at $800,000 so thankfully, even increasing it to $825,000 falls short of your 4% guidelines of modest. I do prefer to underestimate my assets and over estimate my expenses for the most part, but it was fun seeing the spike in Excel when I input the neighbour’s asking rice!

I have my vehicle listed as quite a bit higher than the vehicle loan because we put quite a hefty down payment on it (over $11k if I remember correctly) and the same vehicle on average sells for quite a bit more than our figure, so hopefully it’s okay to leave it as is, but feel free to correct my line of thinking if I’m totally off on this one!

And as for your last comment, I probably should have specified that the GICs are RRSPs. Not quite sure why I omitted that in my tracker, but will add it in my Excel now! Otherwise, yes, it would’ve been much smarter to pay off our HELOC balance. Thanks for pointing it out!

LikeLike

Hiya again. I guess my thinking was more that if you purchased for 560, maybe round up to 600 thousand and then increase that by 4-5 % per year you would likely still be lower. I think I get about 765 thousand now from 2012. Of course, this is all just an “academic exercise” as there is no real right or wrong. It’s just my conservative personality that would rather minimize the upside so that I’m not forced to backpeddle if housing plunges for some reason. At the end of the day, the only way to know the “real” net worth is to liquidate, and I plan on living in my place for a good long time. As far as the vehicle, same idea – if you really could sell it for what you have listed then no harm. Just that vehicles lose value so quickly. In any event, you seem to be doing well and the fact you are focused on these issues is probably more important in the long run that the actual numbers. I guess part of my reluctance to “overestimate” is that when we feel richer, we tend to spend like we are richer – the faster that net worth hits a million, the sooner you start to feel like a millionaire, and spending will almost invariably rise when you think you are worth that much. Therefore, I tend to underestimate and psychologically convince myself that I am not as Scotiabank says ‘richer than I think” therefore it’s easier to stay focused on not spending beyond our means. Take care.

LikeLike

That is a great point!! I love that you added Scotiabank’s slogan LOL! We’re focusing really hard on paying off our debt so thankfully spending is the very bare minimum at the moment. It’s easier to stay frugal when you have a goal, which we didn’t really have after we got the house (took possession in 2012.) We’d definitely be in a much better position had we set some goals and strove towards them but after years of being super frugal, we also felt like we needed a little breather to live a little. It’ll be a long while before we build up enough liquid assets to feel “rich” but it’s definitely a good reminder not to squander whatever we do build up!

LikeLike